Business Trend Analysis on Technology and Payment Methods in Rwanda

Keywords: Rwanda’s E-Learning, E-commerce, Mobile Money, and Cashless Services.

Country: Rwanda

Focus Area: Technology

Technology

The history of technology is the narrative of how systems and techniques were invented. It was originally meant to describe applied art, but it is now used to express evolution and change in the world around us. Different items began to be invented as changes occurred gradually, leading to the current development of technologies such as the computer and nuclear power (Khan, 2018). COVID-19 is a global epidemic unlike any other, with human behavior paralleling WWII and the 1918 Spanish Flu. Physical separation and quarantine were required to suppress the COVID-19 pandemic.

To meet this mandate while maintaining the status quo, various types of human behavior (shopping, learning, functioning, gathering, and entertaining) have shifted from offline to online. This has resulted in an accelerated diffusion of emerging digital technologies among ordinary people, while the digital divide between citizens with and without access to the technologies has widened (Vargo et al., 2020). In this article, the author highlights two trends in Rwanda’s technological sector, namely E-Learning, and E-Commerce, in the context of a business trends analysis.

E-Learning

Due to the Covid-19 pandemic, about 4 million schoolchildren were obligated to stay home in Rwanda, which took up to eight months. Schools temporarily were closed for quarantine, but the learning continued using different media such as radio, television, and the internet. With the result of Covid-19, all secondary schools, vocational, and higher learning institutions were instructed to adopt digital, online, internet, and distance learning. The covid-19 pandemic has shaped the Rwanda Educational Board to rethink its delivery strategies during emergencies.

With REB e-learning and media such as radio and television, the school’s administrators began to send their lessons and homework through those platforms (Gahima, 2021). However, not every student could afford digital devices such as computers and mobile phones, despite the significant investment made by the government in the ICT sector of Rwanda. The number of internet users in Rwanda was about 4.12 million in January 2021, and the number of internet users increased by 806 thousand between the period of 2020 to 2021. In 2021, the internet penetration in Rwanda stood at 31.4% (“Digital 2021, Rwanda”, 2021).

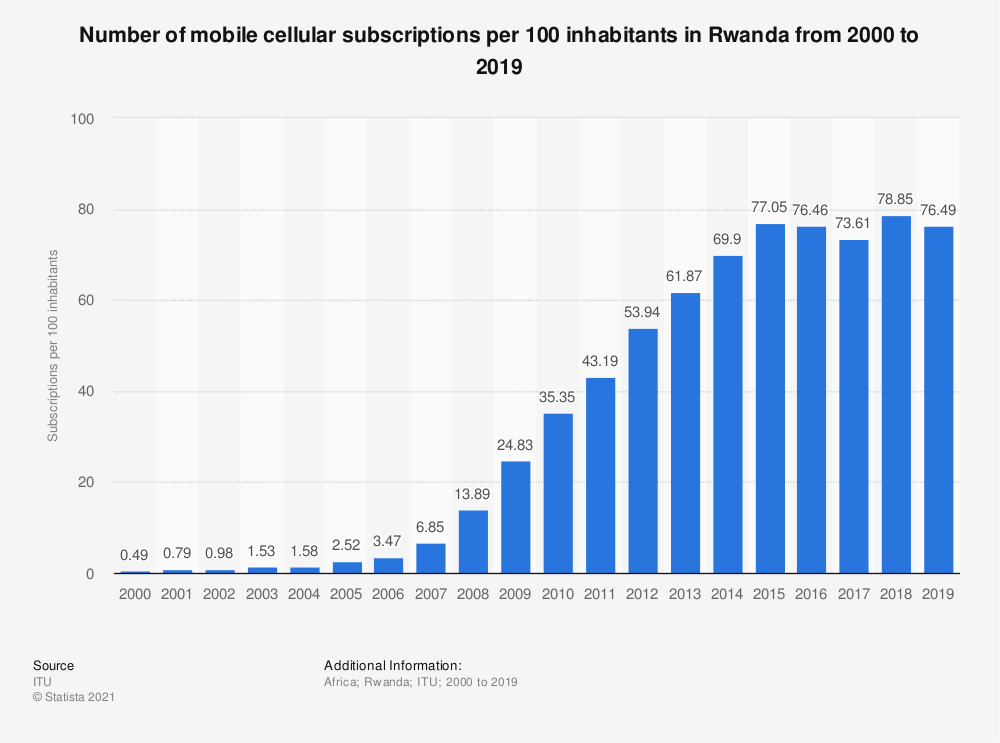

Mobile connections in Rwanda totaled 9.69 million connections in Rwanda in January 2020. At the same time, the mobile connection in Rwanda decreased by 175 thousand in the period of January 2020 to January 2021. The number of mobile connections in 2020 was equivalent to 73.9% of the total population (“Digital 2021, Rwanda”, 2021). E-learning is one of the latest trends in the educational sector of Rwanda due to Covid-19.

With E-Learning, the number of internet users will double up in the future as the world continues experiencing crises like the Covid-19 pandemic. To create equal opportunity for students regardless of their financial status, governments in developing countries must double their investment in the ICT sector to support children whose parents cannot afford technological devices to support their online studies or distance learning.

E-Commerce

As the world shifts away from the traditional form of business, where a transaction in the marketplace is physically present, a transaction in the marketplace can now take place anytime and everywhere without being physically present, and that process is known as e-commerce. One of the most recent changes in Rwanda’s commercial landscape is e-commerce. In 2020, the Rwandan population was estimated at 12.3 million, and approximately 3.8 million get access to the internet; it’s frequently used via smartphone. The internet speed is improving, particularly driven by the national 4G network and fiber optic cables (“Rwanda – Country Commercial Guide”, 2020).

The Rwandan government uses e-government portals like Irembo to provide services to both individuals and companies in an effort to enhance internet connectivity. In the spirit of Covid-19, the government of Rwanda has heavily promoted the use of mobile money and internet banking to help contain the spread of Covid 19.

Rwandan e-commerce is booming, driven by rising demand for fast-moving consumer items and entertainment electronics (computing products and accessories, and decoders). Small and medium businesses, such as Kashia and DMM, are among Rwanda’s main e-commerce players. Vuba vuba, Yego taxis, Groce Wheels, and Move Rwanda all deliver goods and services to many people via the internet (Louis, n.d.). All of the e-commerce business and trade models listed above give the new potential for entrepreneurship and job creation. Although e-commerce is still relatively young in Rwanda, the business is rapidly expanding.

Several new tech start-ups and multinational companies have been launching operations in the country in recent years. According to UNCTAD’s B2C E-commerce Index 2018, Rwanda is placed 116th out of 151 economies globally and 19th out of 44 African nations in terms of e-commerce. Emerging businesses like Vuba vuba and kikuu are now boosting their market share because of increased demand for online buying, especially during this pandemic wherein people can be at their homes and put in their orders on any web-based platforms and receive the items purchased.

Payment

The payment method has been changing from the traditional way to more digital nowadays. With the help of technology, payment can happen without exchange in cash, it can happen through electronic and mobile money transfers. The Rwanda National Payment System has advanced significantly with the deployment of several payment systems/services such as RIPPS (Rwanda Integrated Payments Processing System), card-based payment services on both ATMs and POS terminals, in addition to cash and paper-based instruments like cheques and credit transfers, new types of POS (such as mobile, QR, and NFC), internet, and mobile phone-based payment systems are emerging (“National Bank of Rwanda”, 2020).

Mobile Money

Mobile money transfer is one of the latest trends in the payment services industry in Rwanda. In Africa, mobile money has gained traction as a technique for financial inclusion among the unbanked (Kamande et al., 2020). Mobile money has become an important element of Africa’s financial services environment, according to McKinsey & Company (2017), with one out of every ten African adults possessing a mobile money account.

The financial and technological industries, according to Rwanda’s Vision 2020, are critical to the country’s transformation into a knowledge-based middle-income nation. One initiative aimed to achieve a financial inclusion rate of 90% among adults by 2020. In 2010, MTN became Rwanda’s first mobile money provider, followed by Tigo in 2011 and Airtel in 2013. SACCOs and mobile money platforms, both of which are regulated by the Rwandan National Bank, are currently the primary sources of financial services. (Kamande et al., 2020).

In Rwanda, the number of mobile money registered accounts reached close to 16 million in 2019, up 43.9% over the previous year. Since 2012, the number of subscribers has been steadily expanding, up from 1.44 million in that year. The only year in which accounts declined was in 2017 when they fell by 6.8% from the previous year (“Statista”, 2019).

Cashless payment

Cashless payment is a payment method for making a financial transaction between two people. It is an alternative payment method using coin or paper currency. Since the beginning of COVID-19, Cashless payment has been on the rise in Rwanda. For example, more than 20 thousand taxi drivers in Kigali got back on the road to carry passengers after spending a long time. Currently, they have been introduced to a new digital payment system that totally condemns cash payments (DW, 2020). This became possible through the partnership of the Rwandan government with Pascal Technologies after providing over 20,000 meters for taxi motorcycle riders in Kigali (Saltzman, 2021).

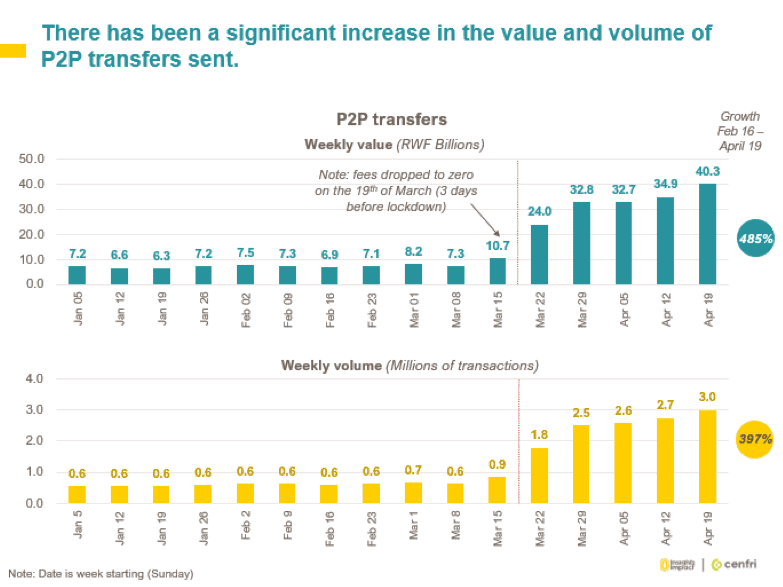

Rwanda has taken a significant step toward conducting business without the use of physical money. The country has a lot of cashless payment methods. Some of these include Mobile Money, Tap&Go, Visa Card payment, etc. The COVID-19 pandemic has even increased the demand for cashless payment in the payment sector, making it one of Rwanda’s latest trends in the payment industry. The implementation of the lockdown even grew the in-person-to-person transactions in volume and value, which has been exceptional (Carboni & Beter, 2020).

During the period of lockdown, the person-to-person transfer has significant increase, and this has remained regular. It was a little bit slower but still continued to grow until April end. The total amount of payments through P2P transactions was about 7.2 billion Rwandan Franc, equivalent to $7.6 million in January. By the end of April, it had an increase of over 450%; it reached 40 billion Rwandan Franc, equivalent to more than $42 million (Carboni & Beter, 2020).

These significant increases in the cashless payment occurred as a result of the CoronaVirus. Due to that, cashless payment is one of the latest trends in the payment industry in Rwanda. It can be forecasted that this trend will continue in the country for decades to come because it continues to increase day by day.

Conclusion

The covid-19 pandemic has been a huge opportunity for innovators or developers, and entrepreneurs to provide viable solutions for us as people to interact with one another and purchase goods and services online during any crisis like a pandemic. Due to the covid 19, there has been a tremendous increase in the technological sector of doing business, which can also serve as a means to recognize opportunities from different angles as the world keeps on changing; new opportunities, challenges, and risks will emerge.

References

- Carboni, I., & Bester, H. (2020). When Digital Payment Goes Viral. nextbillion.net. Retrieved 17 October 2021, from https://nextbillion.net/covid-rwanda-mobile-money/.

- COVID-19 Boosts Rwandan Cashless Economy. borgenmagazine.com. (2021). Retrieved 17 October 2021, from https://www.borgenmagazine.com/rwandan-cashless-economy/.

- Digital 2021, Rwanda. datareportal.com. (2021). Retrieved 17 October 2021, from https://datareportal.com/reports/digital-2021-rwanda.

- Eco Africa. DW.com. (2021). Retrieved 17 October 2021, from https://www.dw.com/en/rwanda-to-start-new-cashless-era-after-covid-19/a-54038132.

- E-commerce in Rwanda. lloydsbanktrade.com. (2018). Retrieved 17 October 2021, from https://www.lloydsbanktrade.com/en/market-potential/rwanda/ecommerce.

- Gahima, E. (2021). The Rwandan Education Sector needs Digital Innovation Policies for the Post-Pandemic Era. southervoice. Retrieved 17 October 2021, from http://southernvoice.org/the-rwandan-education-sector-needs-digital-innovation-policies-for-the-post-pandemic-era/.

- Kamande, M., Kamanzi, A., Qureshi, F., & Kituyi, A. (2020). Rwanda Mobile Money Report [Ebook]. usaid.gov. Retrieved 17 October 2021, from https://www.usaid.gov/sites/default/files/documents/Rwanda_Mobile_Money_Report_Final_0.pdf.

- Khan, N. (2018). History and evolution of technology. nation.com. Retrieved 17 October 2021, from https://nation.com.pk/23-Jul-2018/history-and-evolution-of-technology.

- Louis, G. Setting the Scene of Rwanda’s E-commerce Competitiveness: [Ebook]. EPRN. Retrieved 17 October 2021, from https://www.eprnrwanda.org/IMG/pdf/gitinywa_e-commerce_16102020.pdf.

- Mudingu, J. (2019). Tap&Go and the myth that surrounds it. newtime.com.rw. Retrieved 17 October 2021, from https://www.newtimes.co.rw/news/featured-tapgo-and-myth-surrounds-it.

- National Bank of Rwanda bnr.rw (2020). Retrieved 17 October 2021, from https://www.bnr.rw/payment-systems/.

- Rwanda – Country Commercial Guide. International Trade Administration. (2020). Retrieved 17 October 2021, from https://www.trade.gov/country-commercial-guides/rwanda-ecommerce.

- Statista. Statista.com. (2019). Retrieved 17 October 2021, from https://www.statista.com/statistics/1187558/mobile-money-registered-accounts-in-rwanda/.

- Vargo, D., Zhu, L., Benwell, B., & Yan, Z. (2020). Digital technology use during COVID-19 pandemic: A rapid review. onlinelibrary.wiley.com. Retrieved 17 October 2021, from https://onlinelibrary.wiley.com/doi/10.1002/hbe2.242

About the author:

Sidiki Kamara is a Bsc Student in International Business and Trade in Rwanda, Kigali. He is a social worker, social entrepreneur, business developer, and researcher. He’s also a co-founder of CYGEC IT SOLUTIONS, INC, and social media manager for Educate-Children Liberia.

This is a brilliant article.

Great work Sidiki Kamara

Amazing ✍️ up Sidiki

Thanks for taking your time to go through.

Great work!

Amazing piece @Sidiki. I believe Rwanda is at such a peak due to stable electricity.

Indeed, electricity is one of the key factors for such a development in the technology sector of any developing countries in Africa and around the world.